ctcLink Accounting Manual | 40.55 Liabilities

40.55 Liabilities

07/16/2025

40.55.10 Definitions

Liabilities

Liabilities are legal obligations (often payables or debt) which have arisen from past transactions, and which will be liquidated in the future. Liabilities are classified as either current (short-term) or non-current (long-term).

Current Liabilities

Current Liabilities are short-term legal obligations which arise upon the receipt of goods or services.

In governmental fund type accounts, short-term liabilities are payable from current, available resources. In proprietary fund type accounts, short-term liabilities are obligations payable within one year.

In ctcLink current liabilities use accounts 2000002 through 2050999 with 2000002 as the primary budgetary account and accounts 2030003 through 2050110.

Current liabilities include payroll liabilities (excluding non-current vacation leave, sick leave, compensatory time, or termination benefit accruals). Payroll current liabilities use accounts 2011004 through 2011999 with 2011004 as the primary budgetary account and accounts 2020003 through 2020030 for current compensated absence liabilities.

Non-Current Liabilities

Non-Current Liabilities are financial obligations that are due more than one year in the future that may arise from Certificates of Participation, leases, subscriptions, vacation leave, sick leave, compensatory time or termination benefits.

Depending on the nature of the obligation, long-term obligations of the state are accounted for in one of two ways. Long-term obligations related to, and expected to be paid from, proprietary and trust fund type accounts are accounted for in those accounts (fund long-term obligations). All other long-term obligations (general long-term obligations) are accounted for in the General Long-term Obligations Subsidiary Account (Fund 999).

In ctcLink non-current liabilities use accounts 2100002 through 2200999 with 2100002 as the primary budgetary account.

40.55.20 Current Liabilities

Requisitions

In ctcLink, most short-term payables/liabilities begin with the creation of a requisition in which an employee (with appropriate ctcLink permissions) requests approval for the purchase of goods or services. The correct accounting chartstring is input as part of the request. The requisition must go through the approval workflow established by the college.

Complete instructions for creating a requisition can be found in the ctcLink Reference Center - Purchasing - Requisitions.

Purchase Orders

When all required approvals are obtained, the requisition is available for purchasing staff to create a purchase order (PO) by copying from the requisition. If a purchase requisition was not submitted or required, college purchasing staff may create a new PO.

Complete instructions for creating a PO can be found in the ctcLink Reference Center - Purchasing - Purchase Orders.

Procurement Cards (P-Cards)

Short-term liabilities may also be initiated by staff use of a procurement card depending on college policy.

Complete instructions for use of P-Card can be found in the ctcLink Reference Center - Purchasing P-Cards.

Receipt of Goods

The legal obligation of a current/short-term liability is created when the goods or services have been received by the college.

Complete instructions for receiving goods or services can be found in the ctcLink Reference Center - Purchasing Receiving/Returns.

Voucher Creation

Vouchers can be created in multiple ways:

From a Purchase Order

This will copy information from the PO to complete many fields in the voucher. Detailed instructions for creating a voucher from PO can be found here: ctcLink Reference Center - Create Voucher from PO.

From the Voucher Upload Process

Voucher data is loaded to an Excel Voucher template and uploaded to ctcLink. This is most commonly used for recording Net Pay liabilities from HCM. Detailed instructions can be found here: ctcLink Reference Center - Create Voucher Using a Voucher Upload Process.

From a Purchase Order Receipt

Like creating a voucher from a PO, this function copies information from the receiving document to create a voucher. Detailed instructions for using the receipt of goods or services can be found in the ctcLink Reference Center - Create Voucher from PO Receiving Document.

Entering a Quick Invoice

Any college employee with the appropriate permissions may enter data from the paper (or electronic) invoice. The quick invoice must be reviewed by an Accounts Payable (AP) employee before generating a voucher. Detailed directions can be found here: ctcLink Reference Center - Entering a Quick Invoice.

Entering a Journal Voucher

This process is used to create adjusting accounting entries for vouchers that have been posted, paid and whose payments have been posted. The journal voucher must always have at least 4 Distribution Lines and must net to $0.00. The cash lines (1000070 or 1000199) must also net to $0.00. Detailed directions can be found here:ctcLink Reference Center - Entering a Journal Voucher.

Other methods of entering a voucher include:

- Copying Existing Vouchers

- Single Payment Vouchers

- Adjustment Vouchers

- Reversal Vouchers

- Template Vouchers

- Third Party Vouchers

- Bulk Load Single Payment Voucher

Instructions can be found in the ctcLink Reference Center.

See CLAM 40.90.30 for the accounting guidance for payroll liabilities.

40.55.30 Special Liabilities – Excise, Sales and Use Tax

Sales and Use Tax are a subset of the larger set of taxes called Excise Taxes (see RCW 82). State law requires all agencies to charge and remit sales tax (2010060) on all retail sales and to remit Use Tax (2010070) in the event the supplier/seller did not charge Sales Tax as required.

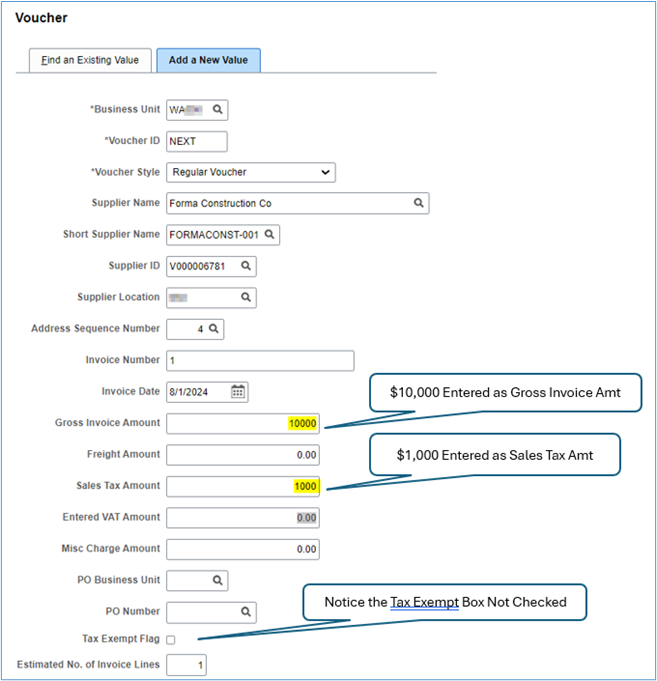

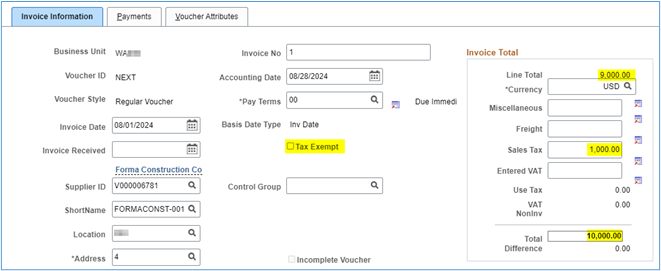

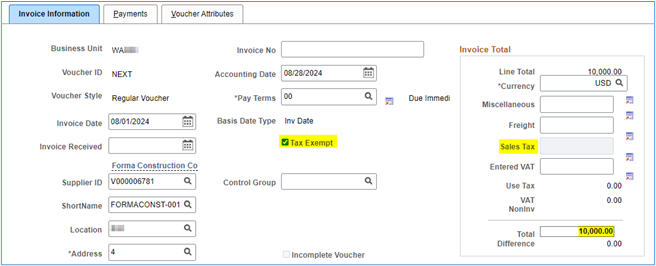

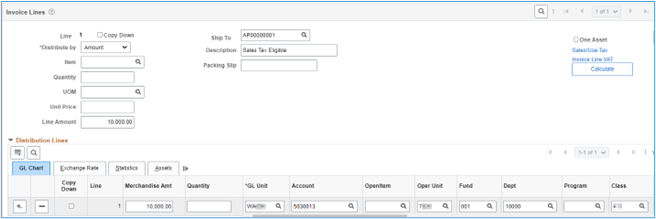

If a college chooses to track sales tax paid by invoice the values can be added when a new voucher is created. In the following example, the total invoice amount is $10,000 including $1,000 for Sales Tax.

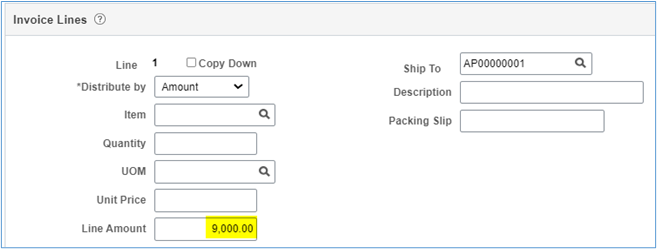

When the voucher screen appears, the Line Amt is reduced by the Sales Tax amount with Total still showing $10,000.

Also notice the Tax Exempt box is not checked.

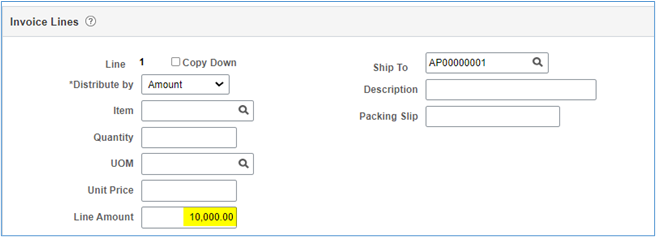

Using this method, the total of all invoice lines must now equal $9,000!

Since the Tax Exempt box is not checked and a value exists in the Sales Tax line, the $1,000 will be distributed across all lines of the invoice. If this invoice contains a single line, the entire $1,000 will be distributed to the single line.

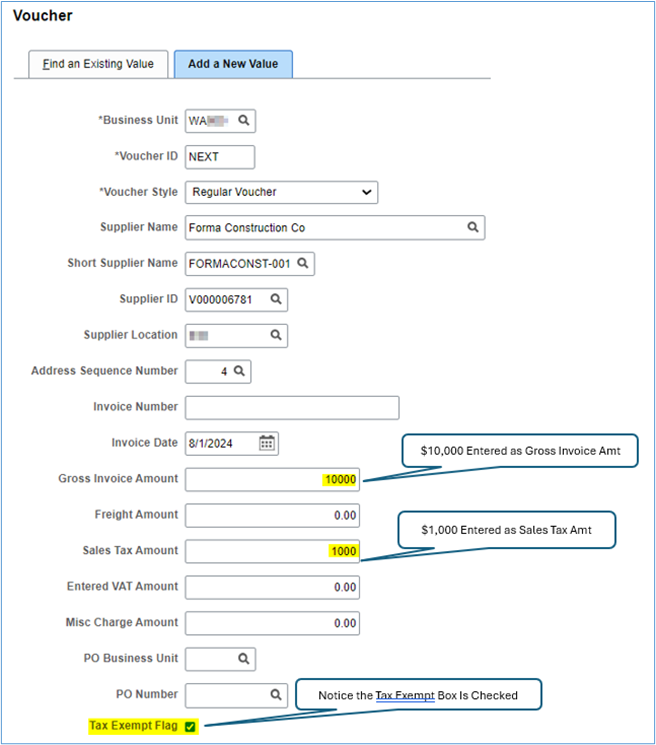

If only some invoice lines should not have sales tax applied, the Tax Exempt box should be checked for those lines to ensure the system will not apply tax to the amounts.

| Account | Funds | Dr | Cr |

|---|---|---|---|

| Expenditure/Expense | Full Chartstring | $10,000.00 | |

| AP Liability - 2000010 | Full Chartstring | $(10,000.00) |

However, if the voucher contains more than 1 line, the sales tax will be prorated between all lines. In this example, with 2 lines at $4,500 each line, sales tax of $500 will be added to each accounting line with total expenditures of $10,000.

| Account | Funds | Dr | Cr |

|---|---|---|---|

| Expenditure/Expense | Chartstring 1 | $5,000.00 | |

| AP Liability - 2000010 | Chartstring 1 | $(5,000.00) | |

| Expenditure/Expense | Chartstring 2 | 5,000.00 | |

| AP Liability - 2000010 | Chartstring 2 | (5,000.00) |

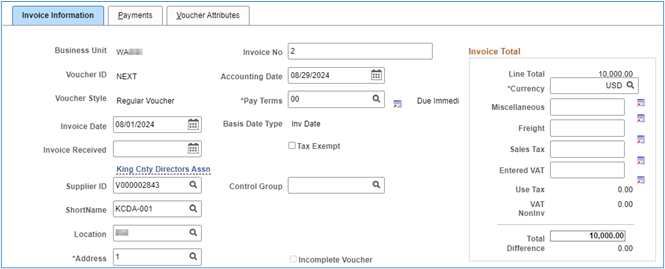

Using the same example as above, but with the ‘Tax Exempt’ box checked.

Invoice information screen:

Since the Sales Tax amount has been eliminated, the invoice Line Amount Equals $10,000 and the total of all invoice lines must equal this amount.

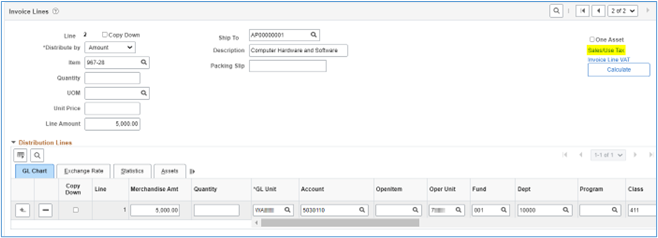

Occasionally, out-of-state vendors omit the addition of sales tax to an invoice, colleges are required to pay the tax on the use of the product in the state. In this example, sales tax was not added to the invoice.

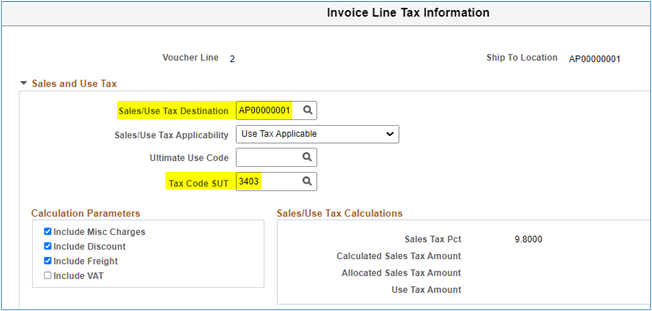

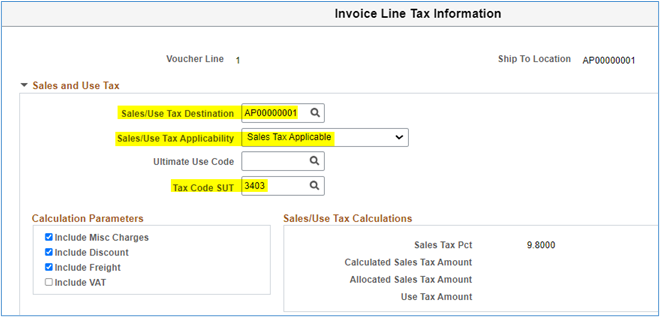

Selecting Sales/Use Tax Screen

In this example, two items were listed on the invoice, but only one invoice line item required the application of use tax. To apply use tax, select the Sales/Use Tax link:

On the Invoice Line Tax Information screen, select the correct Sales/Use Tax Destination Code as well as the correct Tax Code. If you wish to apply use tax, be sure to select the ‘Use Tax Applicable’ from the Sales/Use Tax Applicability drop-down box.

In this example, the Use Tax Pct (rate) is 9.8%.

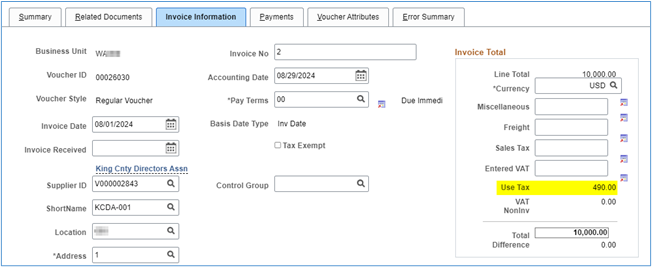

Return to the ‘Invoice Information’ screen and save the voucher.

After saving the voucher, notice the Use Tax amount of $490.00 based on $5,000 times 9.8%.

In this example, Use Tax is only applied to the first line of the voucher and it will not be applied to the second line unless the Sales and Use Tax is changed.

Resulting Voucher Accounting Lines

| Account | Chartstring | Dr | Cr |

|---|---|---|---|

| Expense – 5050120 (non-taxable) | Full Chartstring | $5,000.00 | |

| AP Liability - 2000010 | Full Chartstring | $(5,000.00) | |

| Expense – 5030010 (taxable) | Full Chartstring | 5,000.00 | |

| AP Liability - 2000010 | Full Chartstring | (5,000.00) | |

| Use Tax Exp - 5030035 | Full Chartstring | 490.00 | |

| Use Tax Liability - 2010070 | Full Chartstring | (490.00) |

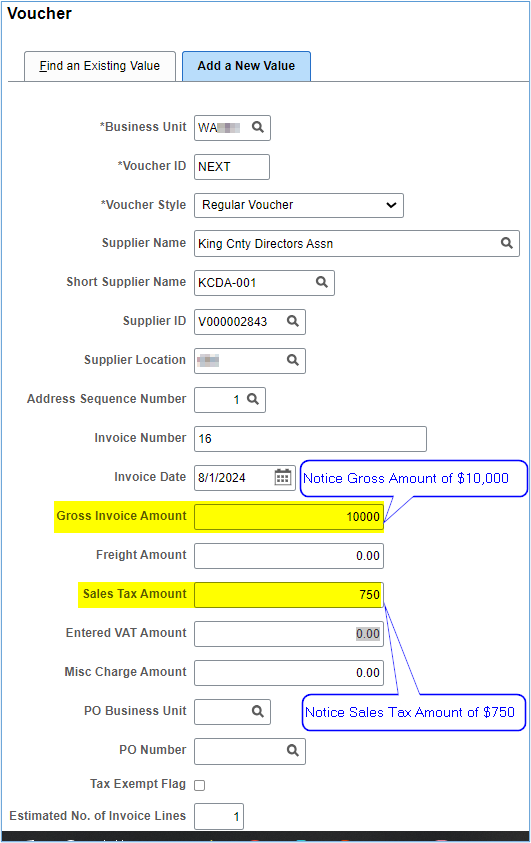

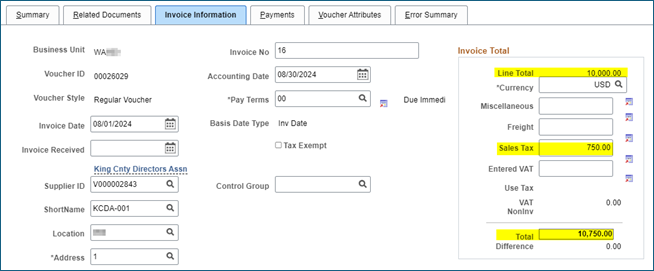

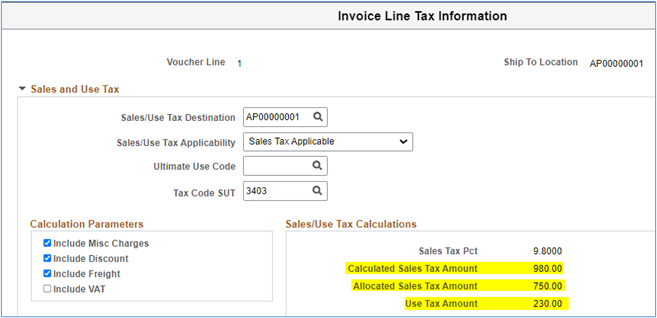

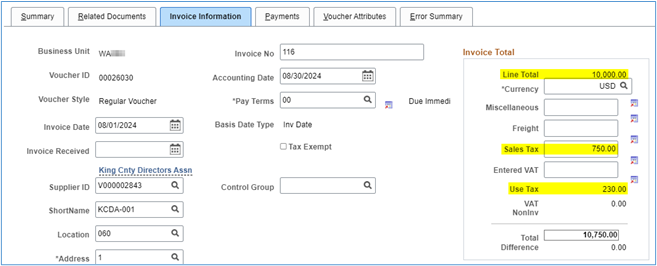

In some cases, the vendor may charge the incorrect sales tax amount so the college will be required to add use tax in addition to sales tax. In this example, the vendor only charged 7.5% sales tax, but the required tax rate is 9.8%. In this instance, the college will be required to record the sales tax on the voucher plus add use tax.

Now, the Line Total is $10,750.00 since Sales Tax will be distributed for payment and accounting distribution.

Next, complete the Invoice Line(s) with the necessary values:

Click on the ‘Sales/Use Tax’ link and complete the Sales/Use Tax Destination, Sales/Use Tax Applicability and Tax Code SUT fields for the location in which tax eligible product will be used. Click ‘Ok’ and Save the voucher.

The system automatically calculates the difference between the Sales Tax collected amount and the required Use Tax amount. As noted above, the vendor is only paid the invoice amount, but Use Tax is allocated to taxable voucher expense lines and Use Tax Liability (2010070) are recorded in the Voucher Accounting Line table.

The Invoice Information is modified to reflect the additional Use Tax.

The resulting Voucher Accounting Lines

| Account | Chartstring | Dr | Cr |

|---|---|---|---|

| Expense – 5050120 | Full Chartstring | $10,980.00 | |

| AP Liability - 2000010 | Full Chartstring | $(10,750.00) | |

| Use Tax Liability - 2010070 | Full Chartstring | (230.00) |

40.55.30.6.a Sales Tax

Colleges must monitor sales tax recorded to ensure correct amounts are collected throughout the month by:

- Manually reviewing vouchers

- Checking receipts in enterprise areas such as parking, bookstore, etc. to ensure the correct amounts are collected,

- Checking Class 042 Ancillary Support Services to ensure the correct tax is collected,

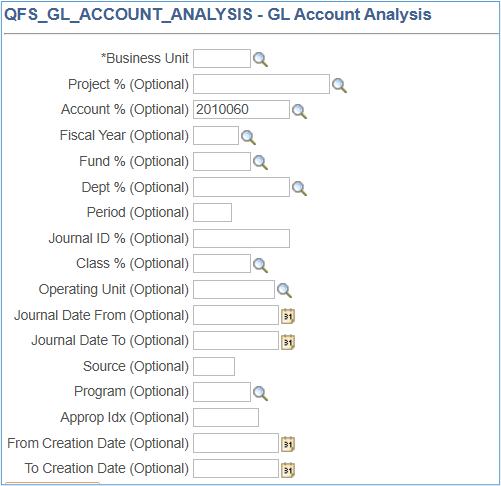

- Review QFS_GL_ACCOUNT_ANALYSIS query results for account 2010060 which will show the balance of sales tax collected and recorded. This query allows searching for transactions with numerous options:

This query provides these results:

| Field | Row 1 Example | Row 2 Example | Row 3 Example |

|---|---|---|---|

| Unit | WAnnn | WAnnn | WAnnn |

| Year | 2025 | 2025 | 2025 |

| Period | 7 | 7 | 7 |

| Oper Unit | 7nnn | 7nnn | 7nnn |

| Account | 2010060 | 2010060 | 2010060 |

| Acct Descr | DOR Sales Tax | DOR Sales Tax | DOR Sales Tax |

| Type | L | L | L |

| Fund | 528 | 569 | 528 |

| Approp | |||

| Dept | 14510 | 14420 | 14510 |

| Dept Descr | Parking-Operations | Food Services | Parking-Operations |

| Class | 252 | 262 | 252 |

| PC Bus Unit | |||

| Project | |||

| Activity | |||

| An Type | |||

| Sum Amount | $164.50 | (478.68) | (70.77) |

| Journal ID | AP00564677 | ARDJ563408 | ARDJ563969 |

| Descr | Accounts Payable | AR Direct Cash Journal | AR Direct Cash Journal |

| State Purpose | N | N | N |

| Status | P | P | P |

| Date | 1/22/2025 | 1/8/2025 | 1/15/2025 |

| Subsid | |||

| Source | AP | AR | AR |

| PC Status | I | I | I |

| Stat | |||

| Sum Stat Amt | 0.00 | 0.00 | 0.00 |

| Program | |||

| Ref | |||

| Line Descr | AP Accruals | AR Direct Cash Journal | AR Direct Cash Journal |

| Creation Date | 1/26/2025 2:28 | 1/23/2025 2:47 | 1/24/2025 2:44 |

40.55.30.6.b Use Tax

The following queries are useful in determining the accrued Use Tax for a specific period, including the chartfields:

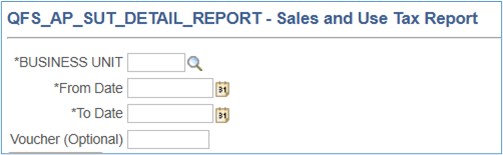

QFS_AP_SUT_DETAIL_REPORT (with Journal ID)

This query returns the results for both Sales and Use Tax recorded for the period selected. Assuming sales tax has been recorded correctly for all other purchases, it might be best to filter for non-zero values in the Use Tax field. (the results are transposed for display purposes).

| Field | Row 1 Example | Row 2 Example | Row 3 Example |

|---|---|---|---|

| Business Unit | WAnnn | WAnnn | WAnnn |

| Voucher | 00015077 | 00015081 | 00015081 |

| Voucher Line | 1 | 2 | 1 |

| Voucher Distribution | 1 | 1 | 1 |

| PO No. | 00000129-6 | 0000002439 | 0000002439 |

| Accounting Date | 1/3/2025 | 1/3/2025 | 1/3/2025 |

| SUT Code | 1702 | 1702 | 1702 |

| SUT Code Pct | 10.3000 | 10.3000 | 10.3000 |

| Amount | 5.53 | 13,513.59 | 18,024.11 |

| Merchandise Amt | 5.01 | 12,251.67 | 16,340.99 |

| Sales Tax | 0.51 | 0.00 | 0.00 |

| Use Tax | 0.01 | 1,261.92 | 1,683.12 |

| Tax Destination | xxSHIPTO | xxSHIPTO | xxSHIPTO |

| SUT Apply | S | U | U |

| Description | Copier Maintenance for Campus | Acalog - Hosting & Support 3/3 | Curriculog - Hosting & Support |

| Journal ID | AP00556557 | AP00556557 | AP00556557 |

| Journal Date | 1/3/2025 | 1/3/2025 | 1/3/2025 |

| Oper Unit | 7nnn | 7nnn | 7nnn |

| Account | 5081250 | 5081230 | 5081230 |

| Dept | 06030 | 06010 | 06010 |

| Fund | 448 | 149 | 149 |

| Approp | |||

| Class | 255 | 041 | 041 |

| Program | |||

| Project | |||

| Subsid | |||

| State Purpose | Y | Y | Y |

| Fund Affil | |||

| Ref | |||

| Type | DST | DST | DST |

| More Info | Copier Maintenance for Campus | Acalog - Hosting & Support 3/3 |

Curriculog - Hosting & Support |

QFS_AP_VOUCHER_USE_TAX

The query returns results from the Voucher Accounting Line including merchandise amount, Sales Tax amount (if the college included the information from the invoice) and the calculated Use Tax amount (the results are transposed for display purposes) based on the Accounting Date range entered.

| Field | Row 1 Example | Row 2 Example | Row 3 Example |

|---|---|---|---|

| Business Unit | WAnnn | WAnnn | WAnnn |

| Voucher ID | 00015077 | 00015081 | 00015081 |

| Status | Postable | Postable | Postable |

| Invoice Number | INV2909930 | INV019243 | INV019243 |

| Invoice Date | 45596 | 45650 | 45650 |

| Accounting Date | 1/3/2025 | 1/3/2025 | 1/3/2025 |

| Supplier ID | V000006689 | V000000871 | V000000871 |

| Supplier Name | Copiers Northwest Inc | Modern Campus USA Inc | Modern Campus USA Inc |

| Approval Status | Approved | Approved | Approved |

| Post Status | Posted | Posted | Posted |

| Oper Unit | 7nnn | 7nnn | 7nnn |

| Account | 5081250 | 5081230 | 5081230 |

| Fund | 448 | 149 | 149 |

| Appropriation | |||

| Class | 255 | 041 | 041 |

| Dept | 06030 | 06010 | 06010 |

| An Type | |||

| Program | |||

| PC Bus Unit | |||

| Project | |||

| Activity | |||

| Subsid | |||

| State Purpose | Y | Y | Y |

| Fund Affil | |||

| Merch Amt Base | 5.01 | 12,251.67 | 16,340.99 |

| Discount | 0.00 | 0.00 | 0.00 |

| Sales Tax | 0.51 | 0.00 | 0.00 |

| Use Tax | 0.01 | 1,261.92 | 1,683.12 |

| Sales Tax Pct | 10.18% | 0.00% | 0.00% |

| Use Tax Pct | 0.20% | 10.30% | 10.30% |

| Total Tax Pct | 10.38% | 10.30% | 10.30% |

10.38% tax is not unusual when the actual tax amount must be rounded to the nearest penny.

QFS_AP_VOUCHER_USE_TAX_DISTRIB

The query returns results from the Voucher Table and the Voucher Accounting Line and provides the accounting distribution in addition to the merchandise and tax amounts based on the Accounting Date range entered.

| Field | Row 1 | Row 2 | Row 3 | Row 4 | Row 5 |

|---|---|---|---|---|---|

|

Business Unit |

WAnnn |

WAnnn |

WAnnn |

WAnnn |

WAnnn |

|

Voucher ID |

00015077 |

00015077 |

00015077 |

00015077 |

00015077 |

|

Status |

Postable |

Postable |

Postable |

Postable |

Postable |

|

Invoice Number |

INV2909930 |

INV2909930 |

INV2909930 |

INV2909930 |

INV2909930 |

|

Invoice Date |

10/31/2024 |

10/31/2024 |

10/31/2024 |

10/31/2024 |

10/31/2024 |

|

Accounting Date |

1/3/2025 |

1/3/2025 |

1/3/2025 |

1/3/2025 |

1/3/2025 |

|

Supplier ID |

V000006689 |

V000006689 |

V000006689 |

V000006689 |

V000006689 |

|

Supplier Name |

Copiers Northwest Inc |

Copiers Northwest Inc |

Copiers Northwest Inc |

Copiers Northwest Inc |

Copiers Northwest Inc |

|

Approval Status |

Approved |

Approved |

Approved |

Approved |

Approved |

|

Post Status |

Posted |

Posted |

Posted |

Posted |

Posted |

|

Fund |

448 |

448 |

448 |

448 |

448 |

|

Oper Unit |

7nnn |

7nnn |

7nnn |

7nnn |

7nnn |

|

Approp |

|

|

|

|

|

|

PC Bus Unit |

|

|

|

|

|

|

State Purpose |

Y |

Y |

Y |

Y |

Y |

|

Class |

255 |

255 |

255 |

255 |

255 |

|

Dept |

06030 |

06030 |

06030 |

06030 |

06030 |

|

Project |

|

|

|

|

|

|

Activity |

|

|

|

|

|

|

Merchandise Amt |

0.00 |

0.00 |

5.01 |

5.01 |

5.01 |

|

Gross Amount (Dup) |

5.52 |

5.52 |

5.52 |

5.52 |

5.52 |

|

Use Tax Amount (Dup) |

0.01 |

0.01 |

0.01 |

0.01 |

0.01 |

|

Sales Tax (Dup) |

0.51 |

0.51 |

0.51 |

0.51 |

0.51 |

|

Account |

1000070 |

2000010 |

2000010 |

2010070 |

5081250 |

|

Amount by Acct |

(5.52) |

5.52 |

(5.52) |

(0.01) |

5.53 |

|

Type |

CAS |

APA |

APA |

UTL |

DST |

The frequency (monthly, quarterly or annual) of filing and submitting taxes to DOR is based on the estimated annual business income. Each college should have received a notification of frequency at the time it received the original tax ID number. However, this could have changed due to a change in reportable taxes. The best practice is to submit sales and use tax monthly.

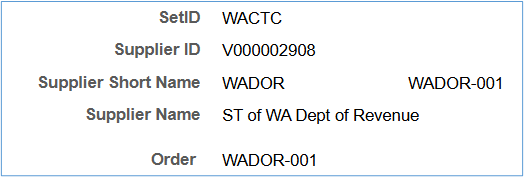

Colleges should use the following Supplier for remitting Sales and Use Tax to the Department of Revenue (Supplier ID 0000048357 is only to be used for Unclaimed Property):

40.55.30.7.a Sales-Use Tax Preview Query

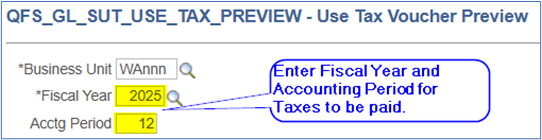

After completing reconciliation of Sales/Use Tax noted in section 40.55.30.6 above, run the QFS_GL_SUT_USE_TAX_PREVIEW query for the final review and verification of AP journals to pay the previous months’ SUT.

QFS_GL_SUT_USE_TAX_PREVIEW

This query returns all transactions for accounts ‘2010060’ and ‘2010070’ for the Fiscal Year and Accounting Period entered in the parameter/criteria fields including payments made to DOR. Some fields are intentionally blank since the field is required for the voucher upload, but values are not required to create the voucher.

| Field | Row Ex. 1 | Row Ex. 2 | Row Ex. 3 |

|---|---|---|---|

| Business_Unit | WAnnn | WAnnn | WAnnn |

| Operating_Unit | 7nnn | 7nnn | 7nnn |

| Account | 2010060 | 2010070 | 2010070 |

| Fund_Code | 524 | 001 | 145 |

| Approp_Index | 8BE | ||

| Class_Fld | 261 | 096 | 162 |

| DeptID | ddddd | ddddd | ddddd |

| Chartfield2 (State Purpose IT) | N | N | N |

| Statistics_Code | |||

| Statistic_Amount | |||

| Quantity_Vouchered | |||

| Description | AR Direct Cash Journal | AP Accruals | AP Accruals |

| PO Business_Unit | |||

| PO Number | |||

| Line Number | |||

| Schedule Number | |||

| PO Distribution Line Number | |||

| Business_Unit_PC | WAnnn | ||

| Project_ID | 000001nnnn | ||

| Activity_ID | ELMAN | ||

| Analysis_Type | ACT | ||

| Resource_ Type | |||

| Category | |||

| Subcategory | |||

| Merchandise_Amount | (111.42) | (12.90) | (17.24) |

| Fiscal_Year | 2025 | 2025 | 2025 |

| Accounting_Period | 9 | 9 | 9 |

| Journal_ID | 00nnnnnnnn | APnnnnnnnn | SFnnnnnnnn |

| Journal Date | 3/8/2025 | 3/10/2025 | 3/25/2025 |

| Source | ONL | AP | SF |

| Journal Header Status | P | P | P |

| Voucher_ID | 000nnnnn |

Next, identify the Journal ID(s) used to make the previous month’s payment to DOR since this Journal ID must be excluded from the Voucher Upload query. A second Journal ID may also be excluded if the college made more than one payment to DOR in the selected accounting period.

40.55.30.7.b Sales-Use Tax Upload Query

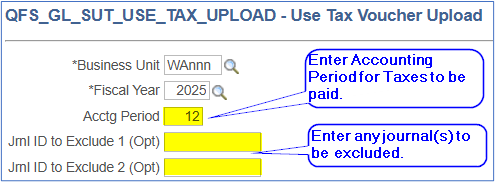

After confirming the results in the previous step and identifying the Journal ID used to make the last month’s payment to DOR run the QFS_GL_SUT_USE_TAX_UPLOAD query for the final review. This query has two additional parameters to exclude DOR payments made during the previous accounting period ([Prior Month SUT AP Journal to Exclude] and [Prior Month SUT 2nd AP Journal to Exclude]).

This query returns the same results as the QFS_GL_SUT_USE_TAX_PREVIEW query but excludes all fields following the ‘MERCHANDISE_AMOUNT’ field.

QFS_GL_SUT_USE_TAX_UPLOAD

Remember some fields are intentionally blank since the field is required for the voucher upload, but values are not required to create the voucher.

Totals will be summarized by the required chartfields resulting in fewer rows.

| Field | Row Ex. 1 | Row Ex. 2 | Row Ex. 3 |

|---|---|---|---|

| Voucher Line Number | 1 | 1 | 1 |

| Distribution Line | 1 | 2 | 3 |

| Business_Unit | WAnnn | WAnnn | WAnnn |

| Operating_Unit | 7nnn | 7nnn | 7nnn |

| Account | 2010060 | 2010070 | 2010070 |

| Fund_Code | 524 | 001 | 145 |

| Approp_Index | 8BE | ||

| Class_Fld | 261 | 096 | 162 |

| AltAcct | |||

| DeptID | ddddd | ddddd | ddddd |

| Chartfield2 (State Purpose IT) | N | N | N |

| Statistics_Code | |||

| Statistic_Amount | 0 | 0 | 0 |

| Quantity_Vouchered | |||

| Description | AR Direct Cash Journal | AP Accruals | AP Accruals |

| PO Business_Unit | |||

| PO Number | |||

| Line Number | |||

| Schedule Number | |||

| PO Distribution Line Number | |||

| Business_Unit_PC | WAnnn | ||

| Project_ID | 000001nnnn | ||

| Activity_ID | ELMAN | ||

| Analysis_Type | ACT | ||

| Resource_ Type | |||

| Category | |||

| Subcategory | |||

| Merch_Amt | 111.42 | 12.90 | 17.24 |

Export the results of this query into an Excel worksheet.

40.55.30.7.c Sales-Use Tax Voucher Upload

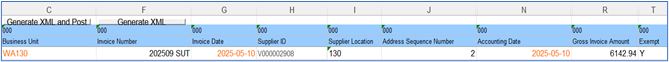

Using the voucher upload process described in the ctcLink Reference Center create the voucher using the template ExcelUpload for Sales-Use Tax Regular AP Vouchers Template.

Copy the results of the QFS_GL_SUT_USE_TAX_UPLOAD Excel worksheet into the Data Sheet beginning at column ‘GO’ (or beginning at Column ‘002 Voucher Line Number’). Exclude the column headers when copying and pasting into the template.

The following fields of the ‘000’, ‘001’ and ‘002’ Record Type section of the Data Sheet must also be completed:

Record Type 000

| Record Type | Label | Value | Value Description |

|---|---|---|---|

| 000 | Business Unit | WAnnn | College Business Unit |

| 000 | Invoice Number | 202509 SUT | Create a valid invoice number with meaning i.e. Mar25 Excise Tax |

| 000 | Invoice Date | 2025-04-10 | Date voucher will be paid |

| 000 | Supplier ID | V000002908 | DOR Vendor ID – DO NOT MODIFY |

| 000 | Supplier Location | nnn | College 3-digit location code for DOR |

| 000 | Address Sequence Number | 6 | Significant only if mailing check to DOR – DO NOT MODIFY |

| 000 | Accounting Date | 2025-04-10 | Date voucher recorded |

| 000 | Gross Invoice Amount | 6142.94 | Total Payable Amount |

| 000 | Tax Exempt Flag | Y | Taxes are never applied to the payment of taxes – DO NOT MODIFY |

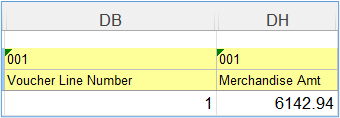

Record Type 001

For a Single Voucher Line Number

| Record Type | Label | Value | Value Description |

|---|---|---|---|

| 001 | Voucher Line Number | 1 | For a single voucher line this value should always be ‘1’ |

| 001 | Merchandise Amt | 6142.94 | Equal to Voucher Line Total Amount |

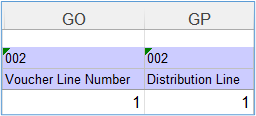

Record Type 002

For a single voucher line, the QFS_GL_SUT_USE_TAX_UPLOAD query includes the value for the 002 Voucher Line Number. The user is required to insert the consecutive line numbers for the 002 Distribution Lines.

| Record Type | Label | Value | Value Description |

|---|---|---|---|

| 002 | Voucher Line Number | 1 | Same as 001 Voucher Line Number |

| 002 | Distribution Line | 1,2,3… | Consecutive numbering beginning at ‘1’ depending on the number of distribution lines |

For Multiple Voucher Line Numbers

It is possible to create a voucher with multiple voucher lines and multiple distribution lines. The sum of the 002 Merchandise Amts must equal the 001 Voucher Line totals for each Voucher Line. The sum of the 001 Voucher Line Merchandise Amts must equal the 000 Gross Invoice Amount.

| Record Type | Label | Value | Value Description |

|---|---|---|---|

| 001 | Voucher Line Number | 1 | Consecutive numbering beginning at ‘1’ depending on the number of voucher lines |

| 001 | Merchandise Amt | 5229.49 | Equal to Voucher Line Total Amount |

| 002 | Voucher Line Number | 1 | Same as 001 Voucher Line Number |

| 002 | Distribution Line | 1,2,3… | Consecutive numbering beginning at ‘1’ depending on the number of distribution lines |

| 001 | Voucher Line Number | 2 | Consecutive numbering beginning at ‘1’ depending on the number of voucher lines |

| 001 | Merchandise Amt | 913.45 | Equal to Voucher Line Total Amount |

| 002 | Voucher Line Number | 2 | Same as 001 Voucher Line Number |

| 002 | Distribution Line | 1,2,3… | Consecutive numbering beginning at ‘1’ depending on the number of distribution lines |

See an example of a complete Excel Voucher Upload.

View and download the Excel Voucher Upload Template for creating the college upload worksheet.

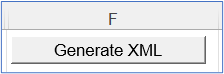

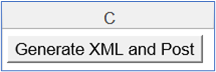

Generate XML

To ensure all fields have the necessary values and click the ‘Generate XML’ button in Column F and save the file.

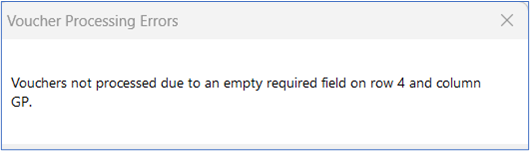

If an invalid value or a value is missing a message like this should pop up:

Generate XML and Post

When all errors are corrected, click the ‘Generate XML and Post’ in Column E

and follow the instructions in QRG referenced above to upload to ctcLink.

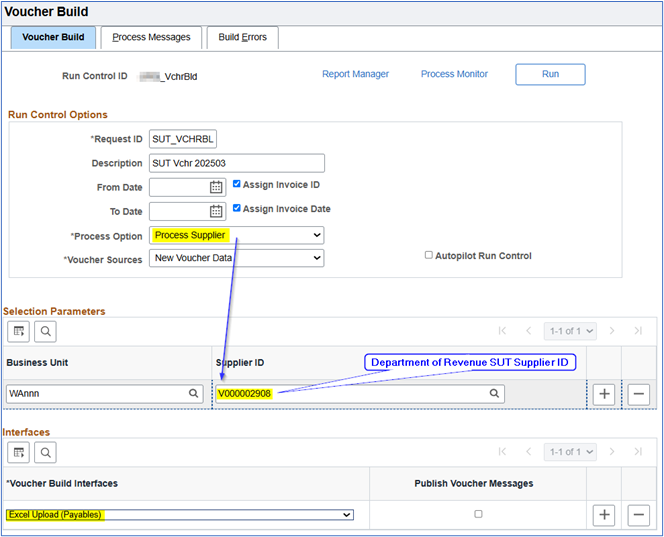

40.55.30.7.d Sales-Use Tax Voucher Build

After loading the voucher, navigate to the Voucher Build page - Navigation: Accounts Payable > Batch Processes > Vouchers > Voucher Build to search for the uploaded voucher:

- Select an existing or create a Run Control ID then select ‘Add’

- On the Voucher Build Request page, enter or select the Run Control Options:

- Request ID – create a value.

- Description – create a useful description

- From Date – may be left blank

- To Date – may be left blank

- Process Option – select ‘Process Supplier’

- Voucher Sources – select ‘New Voucher Data’

- Selection Parameters:

- Business Unit – Enter college BU

- Supplier ID – Enter Dept of Revenue SUT supplier ID: ‘V000002908’

- Voucher Build Interfaces: Select ‘Excel Upload (Payables)

Voucher build

When the process runs to success, search for the voucher using the ‘Find an Existing Value’ screen using the Supplier ID used in the

‘Voucher Build’ process (V000002908 – Revenue Department).

40.55.40 Special Liabilities – Construction Retainage

State law requires state agencies either to withhold a portion of each payment (retainage) or to obtain a bond equal to the amount of the retainage for ALL public works projects.

The contractor has the option to:

- Allow the college to hold the funds,

- Deposit the funds in an interest-bearing account, or

- Place it in escrow with a bank or trust company.

The contractor must exercise an option in writing prior to the first progress payment being made.

The college should always maintain a subsidiary record of the retainage held by contract number and contractor name.

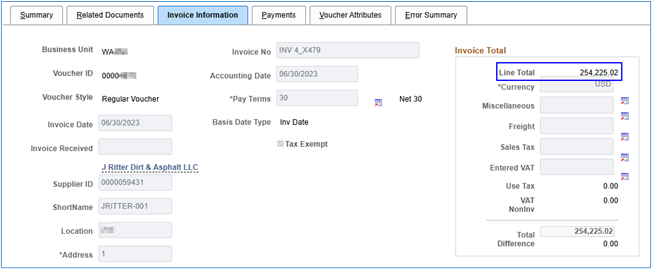

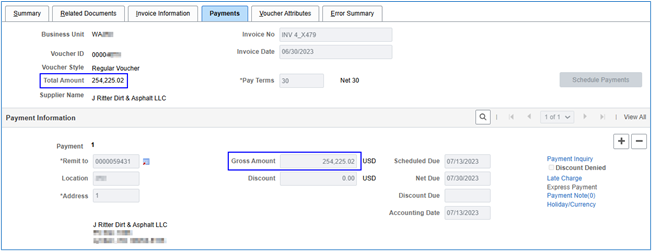

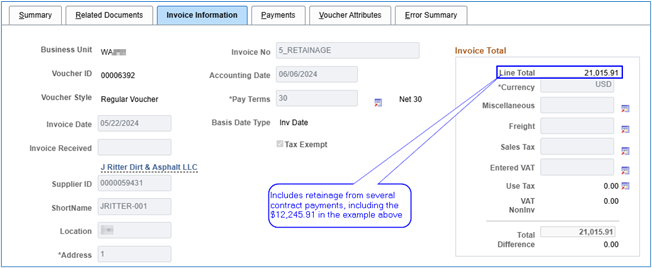

The voucher Invoice Line Total should equal total expenses less retainage. In this example the total invoice was $266,470.93 less retainage of $12,245.91 equals $254,225.02.

The Invoice Line should have these values:

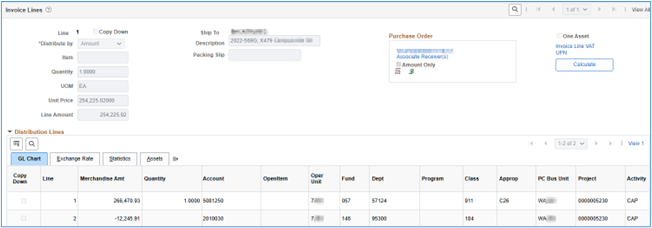

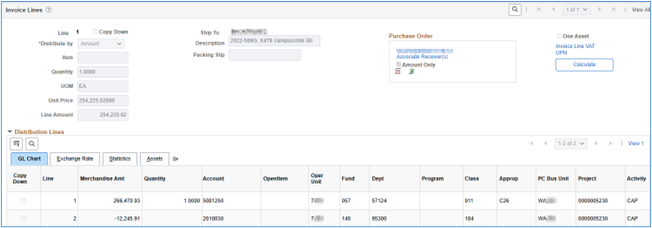

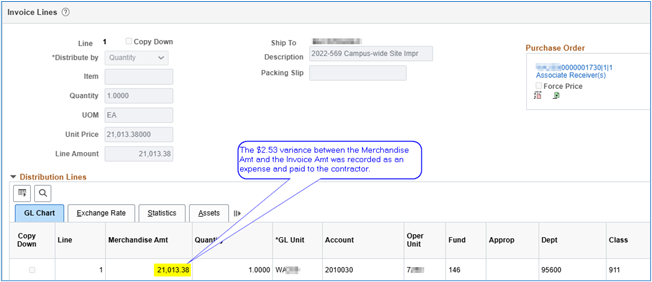

The Distribution Lines show the full invoice amount charged to an expense and a negative value charged to retainage/retention. In this case the college recorded the retainage in Fund 146, Class 184 (Colleges should use Class 182 – Fiscal Operations.

DO NOT USE CLASS 911- since this is Fund 146, the class MUST begin with “1.”

Also, DO NOT USE A PROJECT since all necessary transactions have already been recorded in the project.

The accounting entries in the Voucher Accounting Line looks like this:

| Fund | Approp | Class | Dept | Account | Dr | Cr |

|---|---|---|---|---|---|---|

| 057 | C26 | 911 | 57124 | 5081250 | $266,470.93 | |

| 057 | C26 | 911 | 57124 | 2000010 | $(266,470.93) | |

| 146 | 182 | 95600 | 2000010 | 12,245.91 | ||

| 146 | 182 | 95600 | 2010030 | (12,245.91) |

When the payment processes the contractor is paid the Invoice Line Total:

The Voucher Accounting Line debits the entire Liability and credits Cash in Bank for entire invoice amount, but it also debits cash for the retainage and credits the AP Control account.

| Fund | Approp | Class | Dept | Account | Dr | Cr |

|---|---|---|---|---|---|---|

| 057 | C26 | 911 | 57124 | 2000010 | $266,470.93 | |

| 057 | C26 | 911 | 57124 | 1000070 | $(266,470.93) | |

| 146 | 182 | 95600 | 1000070 | 12,245.91 | ||

| 146 | 182 | 95600 | 2000010 | (12,245.91) |

Therefore, when retainage is due, the payment should be recorded in Fund 146 (in the example) debiting the liability account 2010030.

The system will automatically offset the debit entry with a credit to 2000010. When the invoice is paid 2000010 will be debited and Cash in Bank will be credited. This allows the full expense and full cash credit to be recorded in the capital project.

When the contractor requests the college hold the retainage, the college records the amount retained in Account 2010030 - Retainage Payable ST. However, as demonstrated above, the system will debit 2010030 and credit 2000010 in Fund 146.

The college should maintain a subsidiary record of the retainage held by contract number and contractor name. When all contract requirements have been met, the college should create a voucher debiting the entire retainage held using account 2010030 in the Fund – Class – Dept used to record the original retainage.

Account 2010030 is debited in the Invoice Line to record the retainage about due.

The voucher accrual accounting entries

| Fund | Approp | Class | Dept | Account | Dr | Cr |

|---|---|---|---|---|---|---|

| 146 | 182 | 95600 | 2010030 | $21,013.38 | ||

| 146 | 182 | 95600 | 2000010 | (21,013.38) |

The payment accounting entries

| Fund | Approp | Class | Dept | Account | Dr | Cr |

|---|---|---|---|---|---|---|

| 146 | 182 | 95600 | 2000010 | $21,013.38 | ||

| 146 | 182 | 95600 | 1000070 | (21,013.38) |

When an election is made to deposit amounts withheld in an interest-bearing account, the contractor and college are to select an institution agreeable to both. The banking institution must be a qualified public depository, and the account must be in the college’s name.

The college should record the expenses and make the payment to the contractor in the same manner as above. However, in this scenario, the college should pay the retainage to the banking institution at the same time the payment is made to the contractor.

The process and accounting entries are the same as described above in CLAM 40.55.40.3 Paying Retainage Held By the College.

Interest should be paid to the contractor when the interest becomes payable. The banking institution must report the interest earned by the contractor to the IRS.

When the contractor elects to place amounts withheld in escrow, the contractor selects a bank or trust company as the escrow agent. The college, contractor, and escrow agent are to then execute an escrow agreement jointly (approved as to form by the AG’s office).

The escrow agreement, in addition to other requirements, is to provide for payment of all escrow services and brokerage fees by the contractor and is to stipulate that the contractor agrees to assume all risks in connection with the investment of the retained percentages.

A copy of the completed agreement must be provided to the escrow agent, contractor, and the college before the first progress payment is made.

For additional information see State Administrative and Accounting Manual (SAAM) 85.74 Special Liabilities section 85.74.20.d.(2).

The college should record the expenses and make the payment to the contractor in the same manner as above. However, in this scenario, the college should pay the retainage to the escrow institution at the same time the payment is made to the contractor.

The process and accounting entries are the same as described above in CLAM 40.55.40.3 Paying Retainage Held By the College.

40.50.70 Receivables Accounting << 40.55 >> 40.60 Accounting for Leases